- The FutureProof Advisor Newsletter

- Posts

- Thursday Post: Tracelight

Thursday Post: Tracelight

Happy Thursday,

AI isn’t slowing down—and neither should we. This newsletter is your shortcut to practical ideas and smarter strategies to grow, lead, and adapt as tech reshapes our industry.

To take it one step further, I’ve launched a new YouTube series. Each month, I’m sharing quick, tactical videos showing how advisors can use tools like ChatGPT to save time, think better, and scale more efficiently—starting with the work you're already doing.

Watch my latest episode here

The AI Edge

Helping advisors scale from 1 person to many people.

AI Application:

Overview:

Tracelight is an AI plugin that lives directly inside Excel, turning natural language into sophisticated spreadsheets without leaving your familiar workspace. Unlike standalone AI tools that require jumping between platforms, Tracelight integrates seamlessly into the Excel environment we already know and use daily. You simply describe what you want to build in plain English, and it creates complex financial models complete with multiple scenarios, dynamic inputs, and professional formatting. The tool doesn't just build from scratch – it can also analyze existing spreadsheets for errors and optimization opportunities. Think of it as having a highly skilled analyst sitting right next to you in Excel, ready to build whatever financial model you can describe. The beauty is in the integration – no new software to learn, no data exports, just AI-powered spreadsheet creation within your existing workflow.

How to apply Tracelight to the business today:

Build client-specific cash flow projections by describing scenarios in plain English

Create dynamic portfolio allocation models that automatically update when you change assumptions about risk tolerance or time horizon

Generate retirement planning calculators that show multiple withdrawal strategies side-by-side for client presentations

Build Monte Carlo simulation templates for stress-testing client portfolios under different market conditions

Audit existing Excel models for formula errors or optimization opportunities that might have been missed over time

Advanced:

Create comprehensive financial planning workbooks that integrate multiple planning modules (retirement, education, estate) with dynamic linking between scenarios

Build client onboarding questionnaires that automatically populate risk assessment models and generate initial portfolio recommendations

Develop fee calculation tools that automatically adjust based on AUM tiers, account types, and service levels with built-in compliance tracking

Create performance reporting templates that pull data from multiple sources and generate client-ready charts and summaries

Build scenario planning tools that model firm growth projections, staffing needs, and revenue forecasts under different business development assumptions

What could this application mean for the future of our business?

We're seeing AI tools increasingly integrate into our existing workflows rather than replacing them entirely. This shift matters because it reduces the friction that typically prevents adoption – advisors don't need to learn new software or change established processes. When AI becomes invisible within the tools we already use, it transforms from a novel experiment into daily productivity enhancement. For our industry, this could accelerate the democratization of sophisticated financial modeling. Complex analyses that once required specialized skills or expensive software become accessible to any advisor who can describe what they want to accomplish. The competitive advantage shifts from technical capability to strategic thinking and client relationship management. As these tools become standard, clients will expect more sophisticated analysis delivered faster, pushing our industry toward higher-value advisory services.

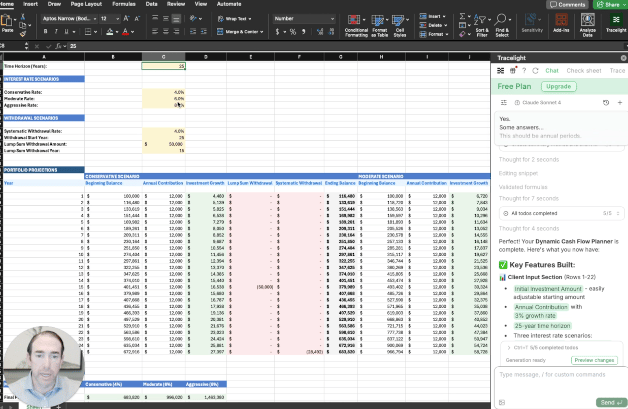

See Tracelight in action:

Watch me build a complete dynamic cash flow planner from scratch using nothing but a conversational English prompt. Within minutes, Tracelight creates a sophisticated model with multiple growth scenarios, withdrawal strategies, and automatic recalculations – the kind of spreadsheet that would typically take an hour or two to build manually. You'll see the tool thinking through its process step-by-step, asking clarifying questions, and delivering a polished result that's immediately client-ready.

-Matt

Do you feel that this tool can add value in your business today? |