- The FutureProof Advisor Newsletter

- Posts

- Thursday Post: You + Gama

Thursday Post: You + Gama

Happy Thursday,

AI isn’t slowing down—and neither should we. This newsletter is your shortcut to practical ideas and smarter strategies to grow, lead, and adapt as tech reshapes our industry.

To take it one step further, I’ve launched a new YouTube series. Each month, I’m sharing quick, tactical videos showing how advisors can use tools like ChatGPT to save time, think better, and scale more efficiently—starting with the work you're already doing.

Watch my latest episode here

The AI Edge

Helping advisors scale from 1 person to many people.

AI Application:

Gamma AI (gamma.ai)

Overview:

Here's what caught my attention: we're so focused on finding the "one tool to rule them all" that we're missing how powerful it is to combine specialized tools. You.com's Deep Research feature is essentially a research analyst that can process hundreds of sources in minutes. Not a summary tool—an actual research engine that asks clarifying questions, develops a research plan, and synthesizes findings from 200+ sources into coherent analysis. The free version doesn't produce polished outputs, which is exactly where Gamma comes in. Gamma takes dense research and transforms it into professionally designed documents that look like something your research team would produce. The combination creates something neither tool does well alone: comprehensive research that's actually presentable to clients or investment committees. What I'm realizing is that the future of productivity isn't about consolidation—it's about orchestration. Knowing which tool does what best, then connecting them into workflows that deliver outcomes we couldn't achieve before.

How to apply You.com + Gamma to the business today:

Client-specific research requests: When a client asks about a specific trend or investment theme, use You.com to compile comprehensive research, then convert it to a Gamma document for your meeting. Instead of manually searching and synthesizing, you're reviewing and refining AI-generated insights.

Investment committee preparation: Research emerging sectors or themes your committee is considering. You.com can analyze 250+ sources on energy trends, semiconductor demand, or healthcare innovation, while Gamma creates the deck or document for discussion. You show up with institutional-quality research.

Competitive analysis for prospects: When pursuing a business owner or executive prospect, research their industry challenges and opportunities. Create a custom analysis document that demonstrates you understand their world better than the wirehouses sending generic pitch books.

Onboarding documentation for complex situations: For clients with concentrated positions, unique industries, or specific planning needs, create custom research documents that show you've done your homework. This sets a different tone than standard welcome packets.

Team knowledge sharing: When junior advisors or operations staff need to understand a complex topic—trust taxation, estate planning strategies, alternative investments—create accessible research documents they can reference. Build your firm's knowledge base without writing everything yourself.

Advanced:

Thematic investment research workflow: Build a repeatable process where You.com researches emerging themes, Gamma creates the presentation, and you layer in your firm's investment philosophy and recommendations. Turn what used to be a week-long project into a few hours of refinement and strategic thinking.

Prospect-specific value propositions: For each significant prospect meeting, research their specific situation—industry trends affecting their business, wealth transfer strategies for their family structure, tax implications of their concentrated position. Show up with a custom document that proves you're not pitching the same story to everyone.

Client education content series: Create a library of research-based educational documents on topics clients ask about repeatedly—market volatility, tax planning, estate strategies, retirement income planning. Each piece backed by comprehensive research but presented in a visually accessible format.

Due diligence documentation: When evaluating alternative investments, complex strategies, or new planning techniques for clients, use You.com to compile research from multiple sources and perspectives. Create documentation that shows your thoughtful evaluation process—valuable for both client communication and compliance files.

Strategic planning research: Before your annual planning sessions, research trends affecting your business model—regulatory changes, technology adoption in wealth management, demographic shifts in your target market. Create strategic planning documents that ground your decisions in comprehensive analysis rather than anecdotes.

What could this application mean for the future of our business?

This combination reveals something important about competitive dynamics: the advantage is shifting from access to information toward the ability to synthesize and present it effectively. Every advisor can Google things. Most can subscribe to research services. But most aren't combining tools to create custom, comprehensive analysis in hours instead of weeks. What makes this particularly interesting is that it democratizes a capability that used to require dedicated research teams. A solo advisor or small team can now produce the kind of custom research that would have required hiring analysts or paying for institutional research platforms. I suspect we'll see a widening gap between advisors who view research as "what gets sent to me" versus those who view it as "what I create for my specific clients and situations." The tools are becoming accessible enough that research quality is no longer a function of firm size—it's a function of whether we've reimagined our research process.

See You.com + Gamma in action:

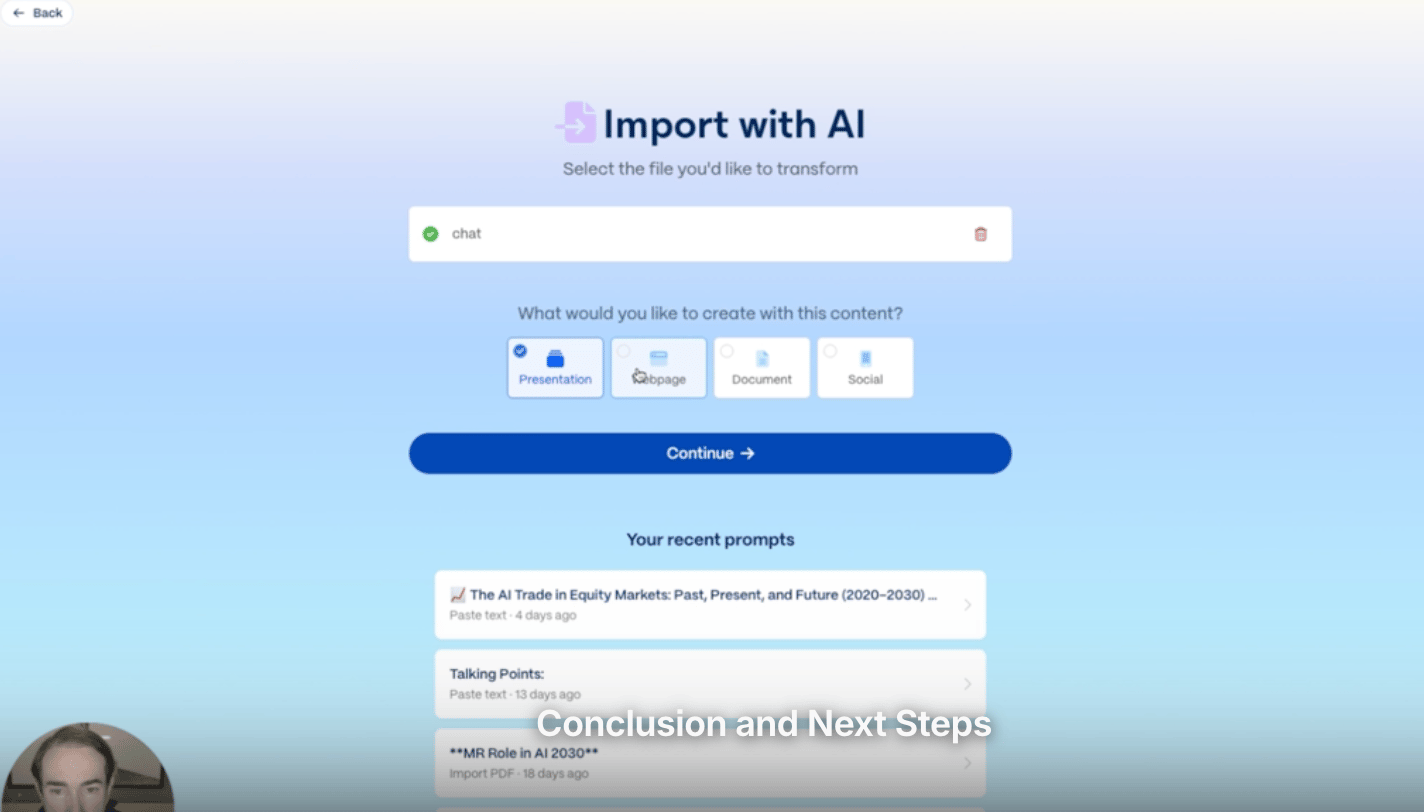

I tested this workflow by asking You.com to research energy consumption trends over five years and project the impact of AI acceleration on energy subsectors. What happened next was what I would expect a senior analyst—it asked clarifying questions (global or US trends? Which sub-sectors?), developed a research plan, then processed 248 sources to create comprehensive analysis. But the raw output wasn't client-ready. That's where Gamma transformed it into an eight-page professional research document with visual hierarchy and clean design. Watch the full video to see how these tools work together to create research outputs that used to require a team of analysts. You'll see the specific prompts I used, how the clarifying questions improved the results, and why thinking in workflows instead of single tools changes what's possible.

-Matt

Do you feel that this tool can add value in your business today? |